It’s important for B2B SaaS start-ups to understand and manage their Customer Acquisition Cost (CAC). The CAC should be quantified as a function of your customer Lifetime Value (LTV) and the time it takes to pay back the CAC. This should ideally be under one year.

Your CAC can grow as your ACV grows. A great way to decrease the payback period is to move to annual plans, paid upfront. This usually is easier than you expect, since the reduced friction for the customer is often enough for them to be okay with the additional commitment.

My guide for managing your team's B2B SaaS sales, marketing, churn, and growth metrics to get your go-to-market on track.

READ ARTICLE

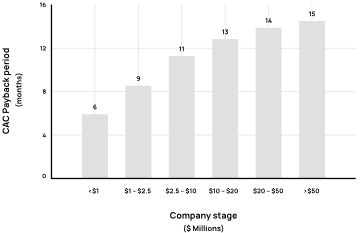

In the below graph, you can see the number of months it takes to recover the initial CAC through customer revenue. As B2B SaaS companies grow, we usually see that this metric, usually called “months to recover CAC,” goes up, as an indicator of the cost of acquisition going up as the company starts competing in a maturing market.

Optimal CAC is not always the lowest. Optimal CAC gets the fastest return of your money through monthly recurring revenue growth. For example, if your CAC is 10 percent higher but gets you a customer who spends 30 percent more (ARPU), that is great.

Here are ways to better manage your customer acquisition costs:

- Channel optimization across search engine marketing, content marketing, social media outreach, events, influencer campaigns, and email marketing.

- Conversion optimization. Make every lead count.

- Consider affiliate marketing programs. Create leverage with your leads.

- Create a referral program. Allow your customers to refer others, especially right after they are excited about what they just bought.