Creating Relevant Content for B2B SaaS Startups

Learn tips on creating relevant content for impactful messaging for your target audience throughout the customer journey to drive B2B SaaS growth.

In the third year of a go-to-market strategy for B2B SaaS companies, you must double your ARR again. Most companies fail at this point. Learn why.

Get monthly GTM frameworks in your inbox.

In my last article, The 5 factors of a T2D3 B2B SaaS marketing strategy, we introduced how only 9% of all B2B SaaS Ventures reach the T2D3 part of their growth journey (26% get to MVP, and 20% get to Product-Market Fit). Once companies embark on the T2D3 path of tripling and doubling ARR every year for 5 years, they start dropping like flies. Most casualties fall when companies get to the 3rd year, and now typically have between $10M-$20M ARR and must double it.

Why do many SaaS companies get stuck after starting fast on the T2D3 journey and are not able to get through the third year?

Going from say $10-20M ARR to $20-40M is a really interesting phase that you go through when you have reached product-market fit, and have invested in growth (usually with external growth capital). Most companies have now picked up the low-hanging fruit, they have secured, and built out, their beachhead and get more opportunities from the type of customers they already know how to win. You sell a bit more to your existing customers and make sure you get acceptable churn levels.

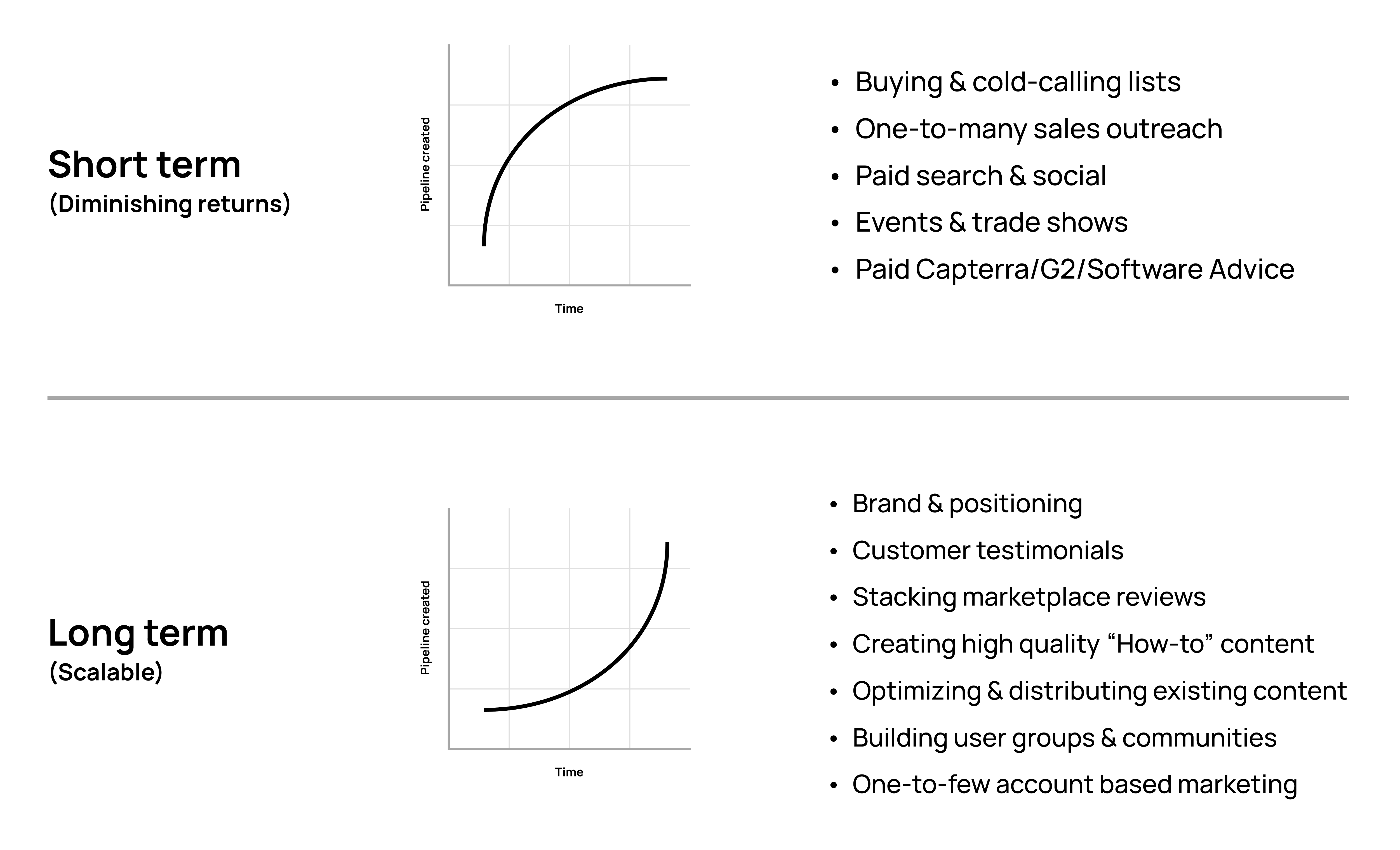

Now the hard part of the journey starts, as your category is maturing, and you are no longer able to just buy a couple of clicks. The clicks are getting too expensive and keeping high rankings in organic search becomes more and more competitive as you are competing with lead marketplaces. These review sites specialize in commanding the top search positions in mature categories (Gartner Capterra, G2 crowd). They are very good at SEO and in a mature category, they likely can hold on to the most valuable keywords, as that’s their core business. It will become clear who the top 2-3 category leaders are going to be and those will get the attention from analysts and win the perception game.

And if you can make it into those, say top three, contender spots, your team is going to be recruited away from you by other competitors who are better funded and maybe more aggressive. So while you have to make sure your talent stays, you also need to get better talent, you need to hire and up-level your team to really get to that $40M+ ARR level, and finish those last two years of the T2D3 growth curve

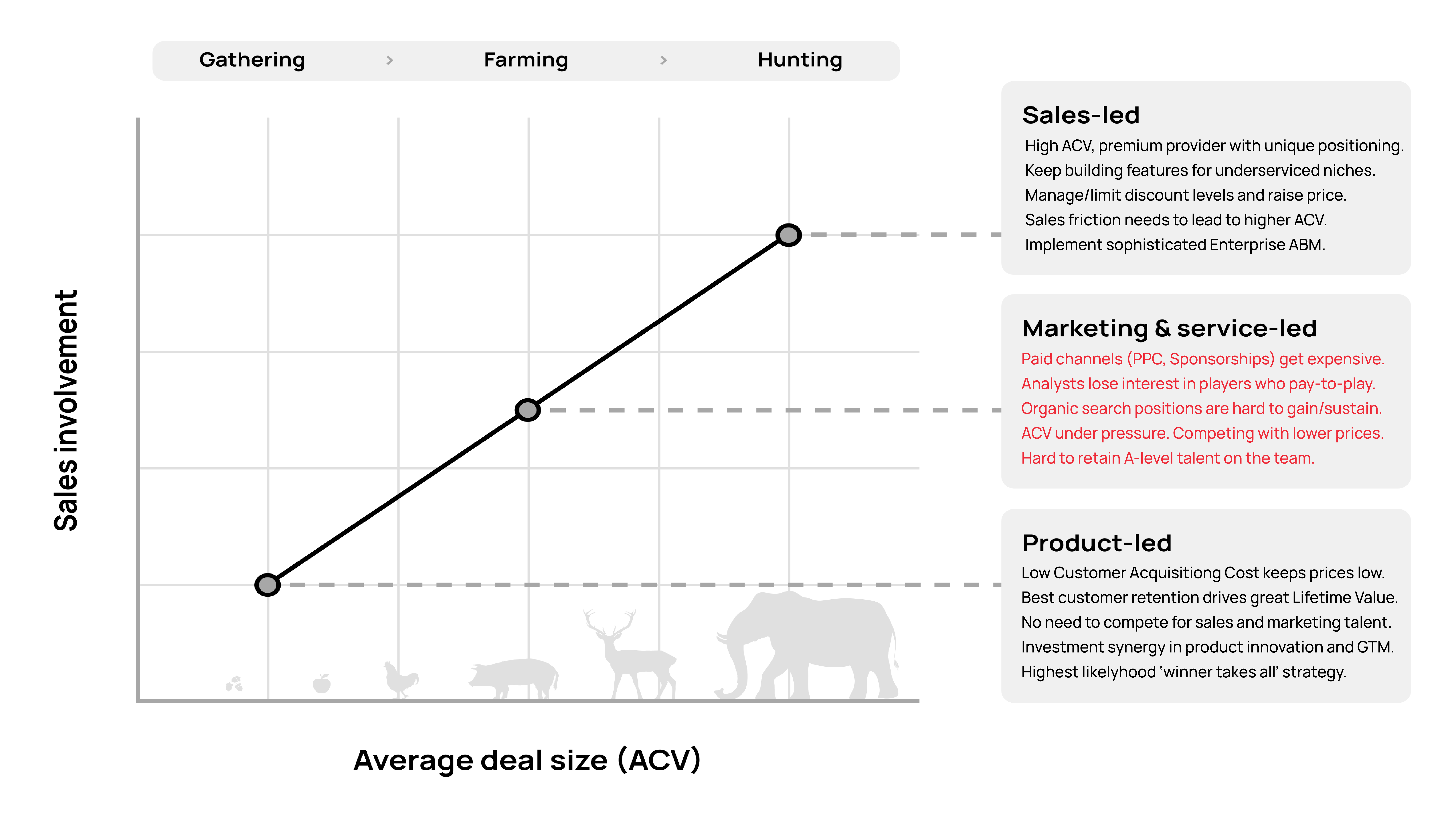

In this article, I will talk about how category maturity has a major impact on your journey, especially in years two and three of the T23D3 growth curve. How do you adjust your strategy? There are basically three grow go-to-market strategies, product-led, marketing-led, and sales-led, and it's very hard to find any company that made it through the year 2-3 of T2D3 and stuck with a marketing-led growth model. Most successful ventures switched to sales-led growth or became the product-led growth category leader. It’s very hard to keep paying for awareness and leads when the marketing category gets too mature. That just gets too expensive in this “winner takes all” part of the journey. Doing the basics is just no longer going to cut it.

There can be many reasons. From the management team and founders not being able to level up and transition to a new form of leadership to ineffective cost management driving the company to ineffective fundraising hunger. There is one reason that is very predictable, and almost certainly something each fast-growing B2B SaaS go-to-market strategy has to account for. The category that you are in will get more expensive, and very competitive, as you pass the $10M ARR mark.

Let’s discuss the 3 things that happen as a category matures, so you can take the appropriate marketing strategy mitigation measures.

In a mature market, marketing-led growth becomes too expensive, and companies who have not secured a leading position using either Product-led growth or sales-led, enterprise sales-led growth, cannot keep up.

At this stage of the category maturity, analysts and beachhead customers will start picking the top 2-3 players in the category. Everyone else is left behind, unless they can carve out a specific niche, like a vertical or Job-to-be-done. B2B SaaS companies who have not mastered analyst relations or secured the best logos and lighthouse customers, or have a referral flywheel that propels them forward, will fall out of the top contenders and die on the vine.

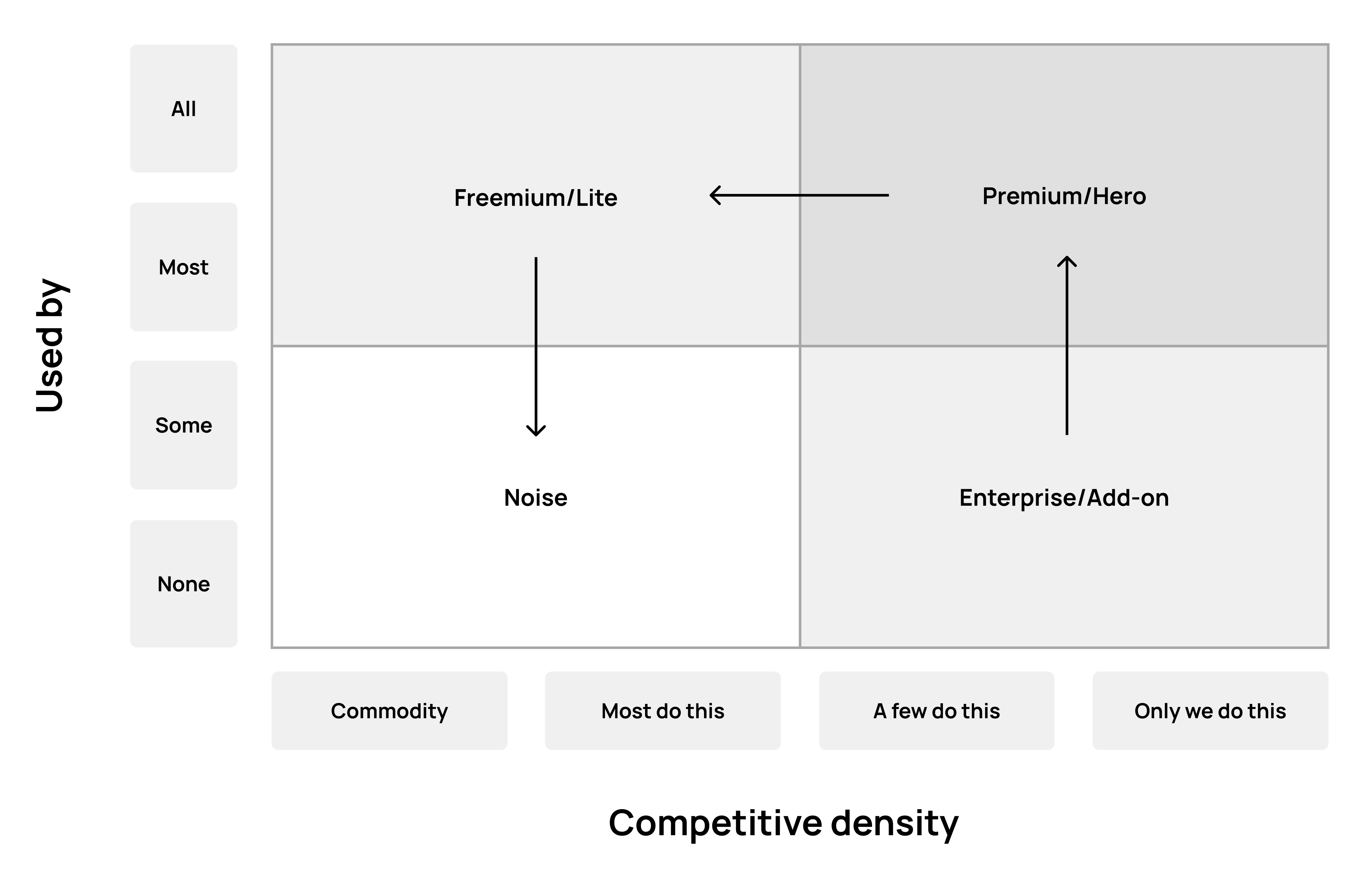

As the category matures, the top players start copying each other in whatever seems to work to win customers. In a SaaS Business model, you expect your clients to keep paying you. Your clients expect you to keep innovating. In the T2D3 book chapter 6.5.2, the Feature Matrix, I share the “Feature Matrix” tool to do product positioning, pricing, and planning. Here is an example of the problem that becomes magnified as a category matures.

As your premium offering becomes “commoditized” you need to keep learning from your clients and innovate. Those innovations will help you stay a premium player. As only the top players in the category will have the customer volume, and resources to invest in R&D, to stay ahead in the innovation race, only a few will make it.

Another tool that I’ve found helpful is discussed in chapter 4.4 of the T2D3 book, the growth (Ansoff) matrix, which has a method to plan for product innovation (the lower right quadrant) at the right time to keep fueling growth as your existing value proposition gets more commoditized.

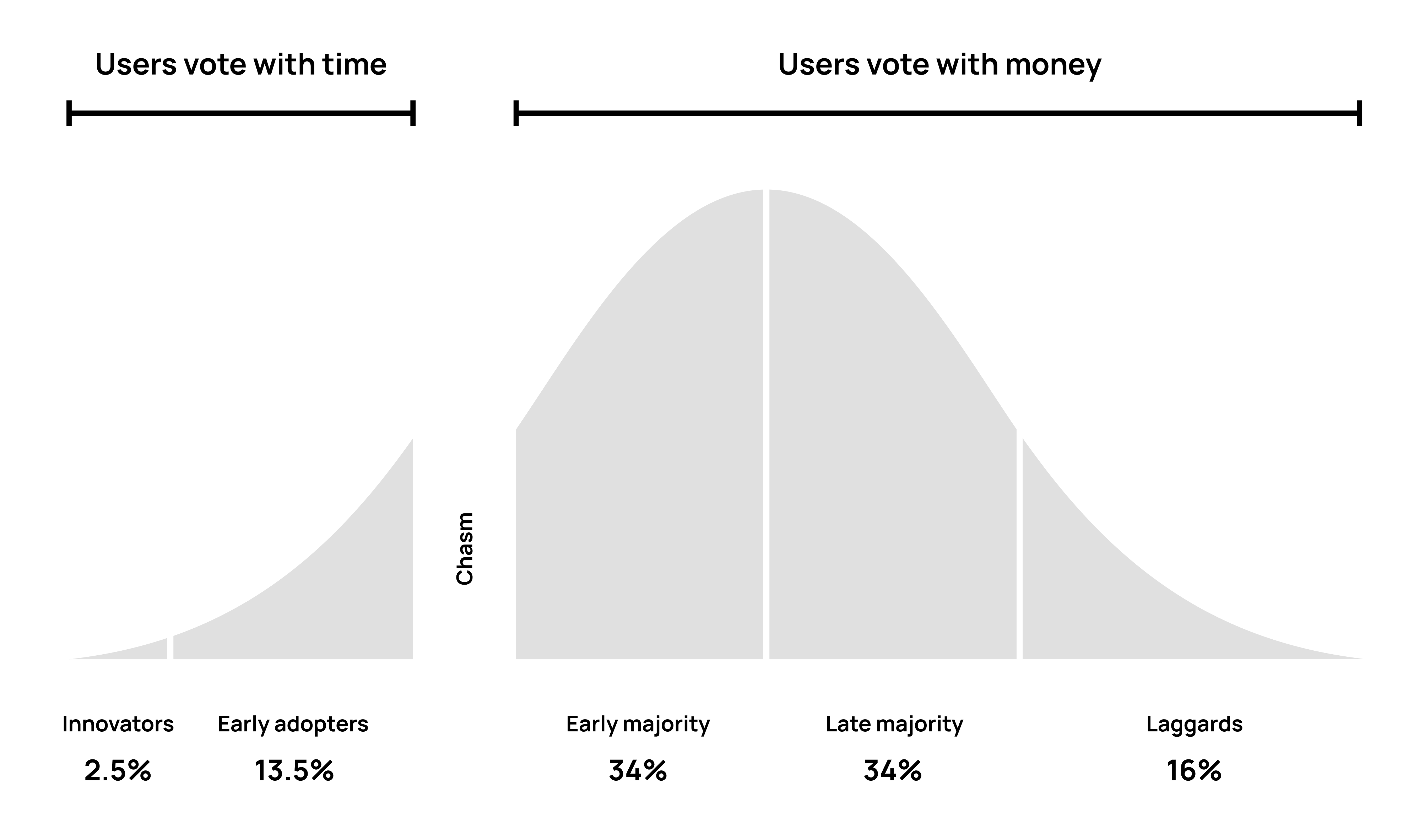

As your audience goes through the Geoffrey Moore, crossing the chasm model, you need to move from targeting your key personas and prospects based on psychographics and Job-to-be-Done to more traditional go-to-market segmentation that fits a mature market, where the people in charge for buying your solution now have specific titles, and you know what industries and departments to target. This is not a common mistake, but still important to be aware of.

.jpg?width=680&name=B2B%20SaaS%20Segmentation%20-%20Visual%20framework%20-%20intersecting%20segmentation%20types%20with%20market%20maturity-min%20(1).jpg)

In the article The 5 factors of a T2D3 B2B SaaS marketing strategy we discussed how you can base your B2B SaaS marketing strategy on where you are in your journey from MVP to product-market fit, and ultimately T2D3 Growth. The other factor to consider is the maturity of the category you are in, as per my previous point, the cost of competing in a market that is maturing will limit your options.

In the article The 5 factors of a T2D3 B2B SaaS marketing strategy we discussed how you can base your B2B SaaS marketing strategy on where you are in your journey from MVP to product-market fit, and ultimately T2D3 Growth. The other factor to consider is the maturity of the category you are in, as per my previous point, the cost of competing in a market that is maturing will limit your options.

You can use many models to review the maturity of the market category you are in. From Gartner’s hype cycle to the Forrester wave. I like to use the Geoffrey Moore Crossing the Chasm model. It helps to think about what your customers look like. How do they make decisions? What are they looking for? You can use that to answer the question, how mature is the category that you’re trying to grow in? How mature is the way your audience buys?

So, let's walk through this. You can think of market maturity from your customers' perspective. Or when you go through this chart here, more from a user perspective.

On the left of the chasm, you will have users who are making maybe decisions to buy a product or to use a product, that are less economical. They're thinking, "Hey, I think this is an important problem to solve. Let me help you build this product." That's really the innovator.

On the left of the chasm, you will have users who are making maybe decisions to buy a product or to use a product, that are less economical. They're thinking, "Hey, I think this is an important problem to solve. Let me help you build this product." That's really the innovator.

The early adopter might be someone who wants to get a competitive edge over their peers, or over someone else. They may not make a complete ROI analysis, but they kind of have a gut feeling, "Hey, this is a great solution that can help me get an advantage."

To the right of the chasm, you'll find customers who are paying much more attention to the economics. To things like ROI, testimonials, references. They want to see others who've gone before them, right? These are more economic buyers.

Why is it so important to know where your market is in this journey? As your market matures, you'll face very specific challenges. Analyst relationships will become increasingly important. They will make maybe it easier or harder to compete for you in the market. You will need a larger number of customer testimonials if you want to play on the right side of the chasm. Prospects will expect references and some proven ROI. Those things become important if your market is more mature.

In addition to those challenges that are kind of in your control, the competition also increases, the more you go to the right. The competition for Google search rankings, organic. Or even the cost of paid clicks.

You will start facing Competitive pressure on pricing. Your solution will be copied by others, so there's commoditization going on. So, you need to constantly innovate. The cost of hiring salespeople will go up if a market is mature.

In a mature market, you also have specific opportunities, but they need a specific approach. You can start, for example, account-based marketing in a more mature market to reach higher ACV values in a certain segment. You can use segmentation to really find an under-serviced part of the market where you can win by having certain capabilities and having a premium position. Or there might be an over-serviced part of the market, where you can win by disrupting that part of the market with maybe a new pricing model, a new business model.

You need to just be aware of how mature your category is. If it's very mature, you also might have an easier path to get more growth capital if you know what you're doing, and you have a good strategy. Because there will be more growth capital available in a more mature market. Here are a couple more of these examples laid out to help you understand if this is a mature market. Is there a category solution name? Is there a name for your category, or analyst covering it?

Is there a Gartner Magic Quadrant? Is there a Forrester Wave? Is there a Capterra category where you see you, where you see your competitors? Is investment coming into your category from private equity Series C, et cetera? These are good indicators that you're in a more mature category. Are there a lot of customer testimonials online, maybe from your competitors? That would indicate that the market is mature. Is your team needing to discount if they need to win? That would indicate a more mature market. Are your prospects really expecting to talk to references? Are they expecting you to do a pilot? To show ROI. So, the buyers are more sophisticated, if you will.

In an immature market, on the other hand, there are a couple of other things. Maybe you are the actual first solution of its kind, and you need to educate the market. If you haven't encountered any competition, you might be in a very immature market, which might be a good thing or a bad thing. You now must prove that this problem is worth solving. If you're an immature market, you might not even be able to get good data from, for example, Google Analytics tools on paid search keywords, because nobody might be paying for the keywords that are describing the problems you're solving. Which also is a fantastic opportunity, right? Now you can maybe get some of that growth relatively cheap. You can still win some of the organic keyword phrases.

There might be growth capital coming into the category, more seed capital or VC, more Series A. That would be an indicator of a more immature market. And what's also challenging in an immature market, while you may have paying customers, there may not be enough history yet to know who of those will stay, and churn data will be a little bit less reliable.

So these are the kind of indicators that help you understand, is your market immature or mature, and what does that then mean for your go-to-market?

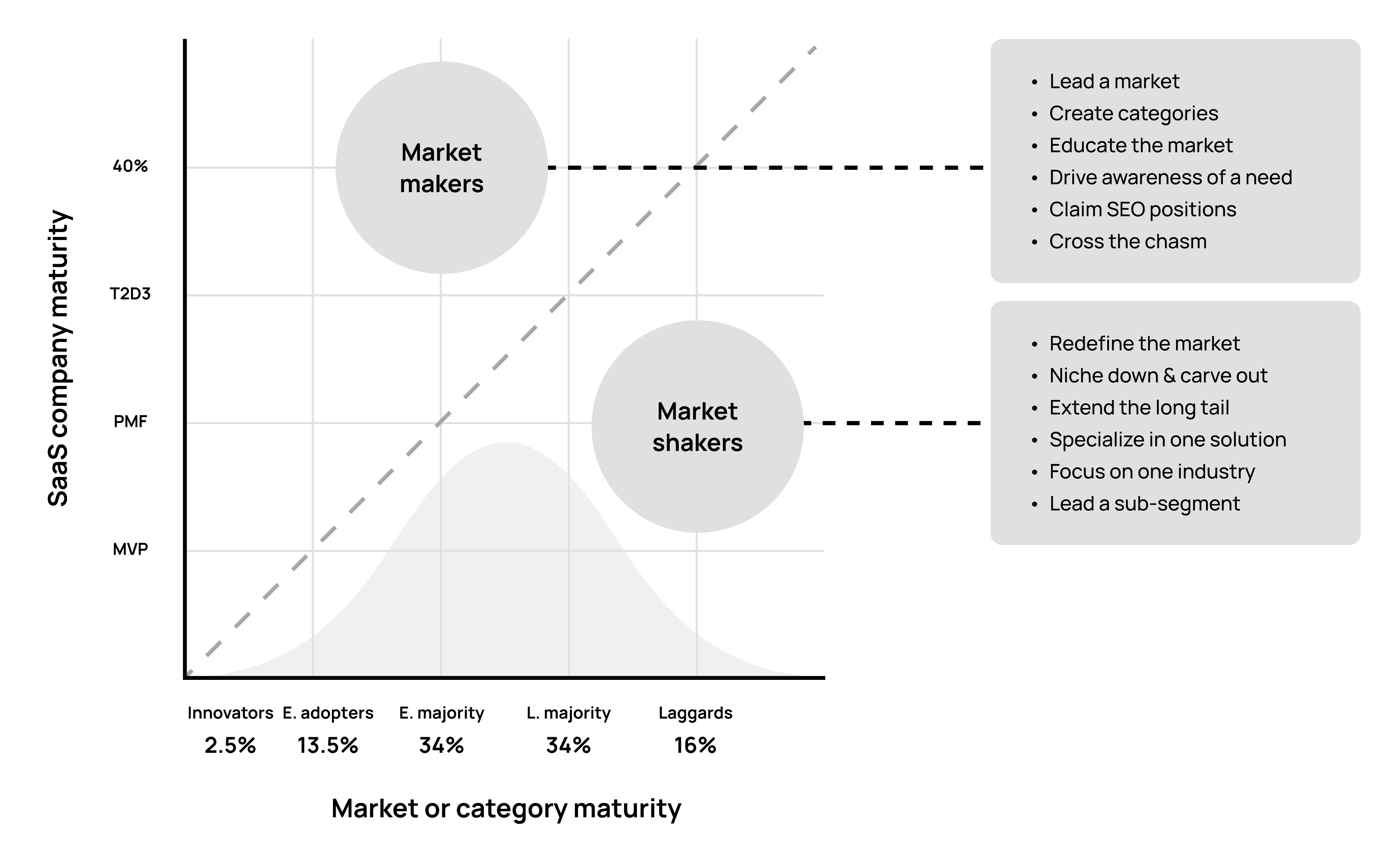

Now let's talk about how we use the three things we talked about. In The 5 factors of a T2D3 B2B SaaS Marketing strategy, we discussed how the size of the ACV, can limit, or enable certain go-to-market models. We also covered the journey that you're on as a company, which is in this chart the vertical axis. This is your journey from MVP to product-market fit to T2D3 and ultimately to 100 million ARR.

And in this article, before, we covered the horizontal axis. How mature is the category that you're in?

When you combine these two dimensions, your company maturity, your solution, and the market maturity, you get an interesting dynamic. This graph is not perfect math but is meant as a thinking model about the different B2B SaaS Marketing Strategy choices you now have to make.

But if your solution is relatively mature, if you have established product-market fit or you’re in T2D3 growth mode, and your category is still relatively young, then you're really able to dominate that market. And it's important for you to consolidate that dominant position, to drive analyst coverage, to really secure that. To make sure you keep doing the organic content marketing, the thought leadership that allows you to really build on that sort of winner-takes-all, getting into the category first position.

If you're not there, if you're maybe lower on the vertical axis, and especially if the category you're in is established, then you need to shake up that market. You need to be a market shaker. So, both axes help you pick the right strategy for growth.

On the upper left, market makers can set the price. They can optimize for profitability. You can use things like price and how you position yourself to really be seen as the market leader. The best that people can buy.

Being in the upper right also comes at a high cost. If you're in a relatively young category and you want to dominate it, you need to educate that category. You need to really drive that initial innovation. You don't have the luxury to learn from others who went before you and made mistakes. You're having to make those mistakes. You must pay for that. But then of course, if you become the market leader, that might be worth it.

That's a very different strategy versus the bottom right. The market shakers, need to pursue a differentiation or a disruption strategy. You need to redefine the mature market, to pick a piece that you can really own. To find a niche, as they say. To nail that niche.

If you can’t achieve the upper left as a domination strategy, you can either disrupt or differentiate. Differentiation is typically applicable for a market that has an under-serviced segment. If there are customers in your market that don't get the things they need, there are features that they need, capabilities that are not being serviced by your competition. Then you can create a unique value proposition, and really niche down and own that part of that existing market and become a dominant player there. You must be able to communicate, of course, how special you are. Charge a premium for that and drive this differentiation strategy. That's for a part of the market that is under-serviced.

If there is a part of a mature market that is being over-serviced, if there are customers in that mature market who are getting more than they need, you can pick a disruption strategy. A great example is what Canva, the design app that helps you make greeting cards and posters, did to Adobe. There were a lot of people who did not need everything that Adobe had to offer. They just wanted to do some simple design work. And then Canva came in with a much simpler product that could not match Adobe from a feature perspective, but it just makes things a little simpler. They also added content as part of the value proposition. Canva also came in with a different business model, with a freemium pricing model. And they basically disrupted an existing category that had customers who are being over-serviced.

So, in a mature category, you pick a part of that market that is over-serviced, and you drive a disruption strategy. Or you differentiate in a market that has a part of the market being under-serviced.

We did something like this with Atera, a unicorn that I helped go global in 2015. Atera was a player in what's called the managed service provider software market. There were many other players, like Kaseya and ConnectWise, and they all had the same business model. You basically pay per device that was being managed. Then Atera came in and saw there were a lot of people, technicians mostly, IT technicians, who were over-serviced. They didn't need all the bells and whistles that the existing players gave them. Atera came in with a very revolutionary pricing model (in those days). They basically said, "Let's do price per technician. And make it really about the value-driven by the people who use the product." That pricing model was disruptive, and it drove Atera through a huge T2D3 growth journey and get to unicorn status.

So that's important. In the bottom right of the previous chart, you need to figure out, should you be differentiating or disrupting that existing category? And of course, if the market is less mature, then you'll end up in an opportunity where you can dominate the market. But it will come at the cost of you having to educate that market, that new category that you're helping to create.

And in the long-term T2D3 journey, you really need to be ready to make a choice between Product-led growth, and (Enterprise-) Sales-led growth. While some companies can do both well, this rarely happens before they get to $100M ARR. What I have never seen happen, is if you just bet on the marketing-led growth model. I have not seen that be successful long term. It's a great way to get started, but you kind of need one of these two to really complement that over time to build a sustainable business.

Good luck growing at T2D3 speed!

P.S. Read more about the 5 factors to turn your SaaS go-to-market strategy into T2D3 growth here.

Learn tips on creating relevant content for impactful messaging for your target audience throughout the customer journey to drive B2B SaaS growth.

For your B2B SaaS go-to-market strategy, what's the best way to get to MVP? Learn from the Founder of the SaaS success story Atera here.

These are the characteristics of the four SaaS growth stages every B2B SaaS company needs to walk on their journey to $100M ARR.