Understanding T2D3: The Cheats to a Sustainable Growth Formula

Learn best practices to properly apply the T2D3 formula to your B2B SaaS growth strategy and attain a sustainable growth formula and pricing model.

The SaaS growth curve and strategies of these unicorn companies are seen by many investors as the best way to drive the exponential growth known as T2D3.

Get monthly GTM frameworks in your inbox.

One of the landmarks of the Seattle skyline, the Wells Fargo building, got a new name in 2020. Today it's called DocuSign Tower, after the startup founded in Seattle in 2003.

As a traditional bank, Wells Fargo serves as a broker between people wanting to store their money somewhere safe and other people wanting to use that money via loans.

However, in the past 25 years, the role of storing and distributing money has been replaced by electronic agreements, virtual money, and legal contracts. Companies such as DocuSign have basically taken over the traditional roles of banks and other intermediate institutions.

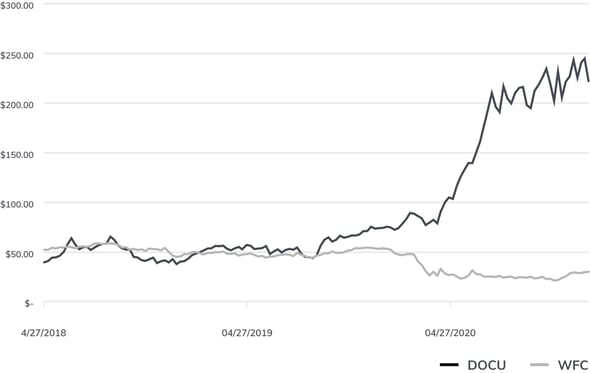

Narratives like these are increasingly becoming the rule, not the exception when pursing B2B SaaS growth. All over the world, SaaS businesses like DocuSign outperform traditional ones such as Wells Fargo. This is clear in day-to-day life but also on the stock market, where “Software-as-a-Service” (SaaS) businesses continue to leave their traditional counterparts in the dust.

The magnitude of the success of SaaS is tough to overstate. Recent history has put the tremendous growth potential of the SaaS business model on display (and some call the past decade the one “when software ate the world”). This has only been underscored by the COVID-19 pandemic, which dealt a death blow to myriad other business types and models. Not only did SaaS companies weather the storm with comparative ease, in many sectors they have become stronger than ever. While highlighted by COVID-19, SaaS’s dominance has deep roots and has been going on for far longer than merely the past few years.

SaaS companies sell software bits in the form of ongoing services. An everyday example is Google Mail. The literal interpretation of SaaS simply includes any type of software solution that is provided as an ongoing service, with some form of ongoing payment commitment by the user. But to be considered a real SaaS business, most professionals agree other conditions need to be met:

Via this model, SaaS has taken the form of anything from advertising platforms to information storage to data processing and communication, and these services are just the tip of the iceberg. SaaS is an extremely flexible model and can be adapted to fit practically limitless cases.

SaaS’s success does not only come from this flexibility. Customers use SaaS because it has critical advantages over other traditional models. SaaS allows users and customers to use sophisticated solutions without the need to buy, install, maintain, or update any software.

Customers pay only for what they use, and the service can be scaled up and down according to the level of usage. Since all data is stored in the cloud, users can access their information from any Internet-connected computer or mobile device. And no data is lost if a user’s computer or device fails.

As SaaS companies have gone on to dominate markets across the globe over the past 20 years, we have gained enough experience and data to really understand how and why these companies succeed, and how to recreate their success.

This site and the T2D3 book are the product of that experience and data, and my own knowledge and best practices that I have gained from 15 years in marketing leadership of SaaS companies. You’ll find not only best practices but an entire framework to guide the journey of a SaaS company, especially through the early stages. While no one can guarantee growth, the T2D3 book provides a script that has been tested, followed, counted on, and improved, for more than a decade.

Growing a SaaS business starts with having a service that fills a need in the marketplace. This is called product-market fit (PMF). Growing a successful SaaS business requires getting to $100 million in annual recurring revenue (ARR) as quickly as possible.

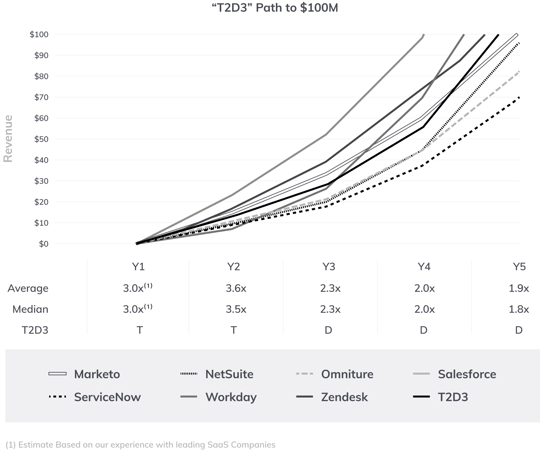

Think about getting to PMF as your business obtaining a significant number of customers who pay for your service and stay. Once you reach this point, you are ready to add marketing, sales, and customer success functions to scale your business. Companies who do so effectively—such as Salesforce and Zendesk—can reach $100 million in ARR at unbelievable speed.

These companies achieved what we now call “unicorn” status, reaching what was thought to be a mythological success. In fact, they did it so quickly that a new expression was coined to describe their steep growth curve—T2D3.

The growth curve and strategies of these unicorn companies are seen by many investors as the best way to drive exponential growth. Now considered the benchmark for SaaS1 success, this growth curve is referred to as T2D3. This acronym stands for tripling your ARR for two consecutive years (T2) and then doubling it consecutively for three (D3).

SaaS companies that are able to do this, achieve sustainable momentum. The success of unicorn companies such as Marketo, NetSuite, Workday, and others has now led investors to establish T2D3 as the go-to metric for growth expectations for early-stage ventures. Simply put, the approach works. Per CB Insights, in 2020 there were 475 unicorns in the world worth a whopping $1.394 trillion. Hence, investments in SaaS companies are very popular with Venture Capital Firms (VCs) and needed by most startups to scale fast.

The crucial moment of truth for a typical SaaS venture happens right as it hits PMF (Product Market Fit2). Annual recurring revenue is still under 10 million dollars. But this number only reflects a small part of the Customer Lifetime Value (CLV) that the business has now secured.

Successful SaaS economics require low customer churn, ongoing subscription payments, and a natural expansion of what each customer pays to yield average growth rates that are unmatched by any other business model. This means that once the PMF milestone is achieved, it’s time for most SaaS companies to go big or go home.

Hitting these incredible SaaS growth rates is by no means easy. A SaaS business is like a big flywheel of growth that can be unstoppable once it gets traction. However, it takes a significant amount of initial energy to gain momentum. The critical period that follows right after you achieve PMF will determine if your SaaS company will grow by a 35%+ Compound Annual Growth Rate (CAGR), and get from $5 million to $100 million within 10 years.

Because SaaS customers have a high customer lifetime value, getting them also warrants relatively steep upfront costs to acquire customers (also known as CAC, Customer Acquisition Cost). It is essential that SaaS companies turn these investments into a sustainable growth cadence that can support longer payback periods.

Hence, investments in SaaS companies are very popular with VCs and are needed by most startups to scale fast.

Keys for SaaS success are thus first and foremost to get to PMF by acquiring customers, and then it is imperative to retain those customers and grow recurring revenue per customer. Doing this all at the same time is not easy. In fact, as a McKinsey study illustrates, most SaaS companies have only a small probability of making it big, and need to “grow fast or die slow”:

In the T2D3 Book and articles on this website you’ll find concrete, step-by-step actions you can take to be successful. This Podcast focused on B2B SaaS Growth Best Practices has a couple of episodes focused on what can go wrong and how to prevent it (Episode 17 and 18).

After getting to product-market fit, the goal for a SaaS venture is often described as getting to $100 million ARR. Angel or VC investors expect only a small number of their investments to pay off, but those need to pay off big time. So, if you receive angel investor or VC funding, that investment, by definition, comes with high growth expectations. As a founder or B2B SaaS CEO, you need to use this ambitious number as a north star to lead your company. It can help you understand what formula you need to apply and what vision you need for your company to scale.

This website and the T2D3 Book provide you with a playbook that combines the things that I have seen work. It also describes areas of risk and mitigation strategies to achieve this high pace of growth. Getting funded as a B2B SaaS startup is just the first step, after which you must immediately hit the ground running. CEOs who must constantly look over their shoulder and lack the confidence to take bold steps will certainly fail.

Sales and marketing executives for high-growth SaaS companies do not have a great track record when it comes to job retention. They often struggle with the difficult balancing act between the need for speed and exponential growth, and trading quality and relevance for quantity, and making noise. For example, when these types of leaders prepare for their next board meeting, it is tempting for them to just focus on short-term tactics. I’ve personally experienced multiple versions of trying to rush and to wing it…

Don’t fall into the trap of doing the following things:

I’ve always been a huge Seth Godin fan. When “inbound marketing” became a thing, and permission-based marketing was accepted by many as the only way to do marketing, I drank the cool-aid and started to curse everything that was “interruption marketing”, spamming people, or making noise.

While I still believe that the best long-term marketing foundation is relevance, great content marketing, and product-market-fit that makes people find you vs. you trying to find them, the reality is that for most early-stage companies who do something truly innovative, this is not enough.

When you are doing something new, and you’re solving a problem that’s not yet well understood by the market, you need to go knock on some doors. Driving “brand awareness” for early-stage companies typically means you need to go do some outbound marketing, including the potential creation of noise that’s not relevant for everyone.

In the first part of my career, I was a software developer, who turned into a consultant and then sales executive at Microsoft. During my time at Microsoft, I became a marketing executive in my late thirties, and by then, had become a big fan of doing a lot of my leadership and management work in spreadsheets. I fell into the trap of creating a lot of great marketing plans using 12-month or 24-month outlooks with theoretical conversion rate assumptions, working my way back from target revenue numbers to assumed lead volume and funnel projections.

I often spent far too much time doing this vs. focusing on short-term execution. Doing A/B testing, interviewing customers, and finding out what they really valued in our products, should be a higher priority. Understanding how they made their buying decisions, and what parts of our funnel had the most friction or leakage. Only the last 10 years I started to focus on all these short-term priorities, and get extremely focused on OKR execution, replacing most of my annual to multi-year planning.

This is a very common challenge that I was guilty of a lot. It’s tempting in Marketing to start a lot of initiatives. While you have to stop the things that don’t work, many things end up on “pause” or stopped without a conscious decision, but just because you run out of bandwidth. Wetter it is starting a series of webinars, a blog or a podcast, or a bigger effort like building a customer advisory board, make sure you have what it takes to see it through. Have a plan to get it beyond the initial excitement phase, and have a buffer of content to be able to publish regularly before you launch.

When SaaS CMOs (Chief Marketing Officer) and sales leaders get into trouble and lose the confidence of their CEO or board of directors, it is usually for one of two reasons:

While running a startup needs to be done with urgency, some shortcuts can lead to trouble and will waste many of the limited resources available to get it right. You cannot “hope” to get to PMF. You need to make sure you get there by taking the steps in paragraph 2.2.

Betting on SEO (Search Engine Optimization) to magically start producing leads six months after the content gets created, buying lists from suspect sources, and hoping they work, or planning for customers to find your product --or even becoming aware of the need for your product-- by themselves, do not work.

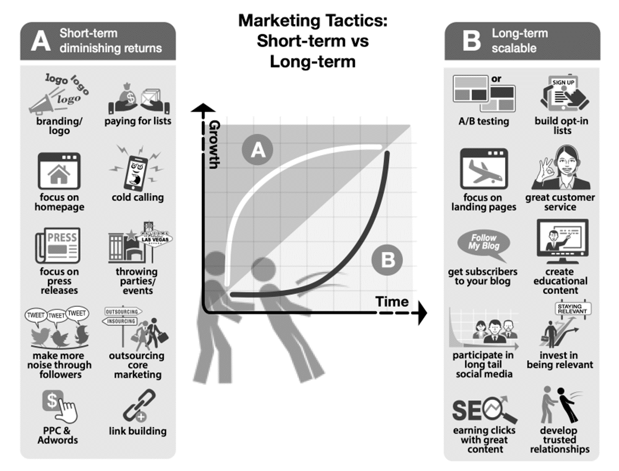

In the marketing tactic graphic that is shown below, the “A” list displays several short-term tactics, the low-hanging fruit that can get you going quickly. This includes things like buying a list or cold calling to produce short-term results. On the “B” side are longer-term tactics, things that take a little more time to generate conversions but are easier—and cheaper—to scale and typically have higher ROI.

The truth is, focusing on the short-term tactics on the left will have some funnel impact, but that approach will not scale. The limited inventory of clicks you can buy, for example, will lead to diminishing returns. Yet by focusing on the longer-term items on the right, you may not have any results at all to show in the short term.

Often, when presented with marketing choices, we tend to think in either/or terms. Instead, the goal should always be to achieve both short- and long-term results at the same time. Ideally, not only will a company pursue both these results at the same time, but they will tie mechanisms for achieving both together, to save cost, hours of labor, and increase scalability.

For example, with display ads, you can turn every paid click into multiple outcomes. In addition to the click being an entry into your conversion funnel, it can be a piece of research doing message testing, and in addition, when you point the click to relevant content that is worth sharing, it becomes an amplification tactic that might at some point result in organic search traffic. Account-Based Marketing is another great example that, if done right, can hit two birds with one stone. In addition to getting a couple of leads that fit your ICP, you can test your ICP, test the messaging and get instant feedback. Finally, social media can be so much more than just making noise. If you engage on long-tail channels like Reddit or Quora, you can find the innovators in your niche, vs. just trying to get as many followers or likes as possible.

I’ve seen many SaaS startups in the past 15 years, and worked with the founders and leaders of these companies, and was a SaaS CEO myself. I met many CEOs who failed, some who gave up, and others that got back up. I also was fortunate to meet more than a few who succeeded big time.

The leadership traits for picking a good startup CEO or investing in a founder who can take the company to scale are well described. What I find is not easy to find are the many details they have to deal with that can derail the journey. How do they approach the things they've often never done before like marketing? Or hiring their first sales leader? And selecting technology solutions from the thousands of SaaS marketing technology tools out there.

This site, and the book, are for SaaS company leaders, their teams, and investors. Investors hoping to hit early with a unicorn and CEOs who have to wear the CMO hat and are making big marketing and go-to-market decisions will benefit from this book. So will the marketers on their teams who want to level up to a CMO-grade understanding of marketing execution and long-term strategy for a B2B SaaS startup. You will find everything from a comprehensive and reliable model on SaaS growth, to easy-to-implement and clever cheat codes to grow B2B SaaS ventures.

If you plan to outsource (some of) your sales and marketing and have never had to manage an agency or CMO, this book can help you master those before you outsource them. You can find some valuable pointers to secure accountability by your marketers and agencies.

What will you not find? Readers who look for a quick fix to PMF, and drum up leads in weeks will not find that in this book. While we believe there are shortcuts by doing things right, and in the right order, there are also steps you can’t skip. You need to learn your ICP. And then test your value prop in MVP style to make sure you make something your customers want and then marry that with the right ICP for product-market fit. It’s hard work but doing it in the right order can save you time and a lot of effort and frustration.

Investments in maritime expeditions in the early renaissance period were arguably the first real venture capital adventures, where adventurous entrepreneurs got backing from the shipowners as the first venture capitalists in history. The absence of easy-to-understand information and metrics, or limited liability legal constructs meant this was the only way to fund these ventures. The three possible outcomes were that a ship would sink, it would return, and profits would be shared, or it fell prey to pirates (sometimes its own crew).

Given the low likelihood of success, the payoff had to be worth it. Today’s typical “carry” to compensate VC General Partners is still a hefty 20%, similar to what it was in the 17th century where the name “carried interest” originated from the same percentage that ship owners and ship captains would get. This site and the book help investors, CEO/Founders, and their marketing leaders minimize some of the risks and maximize the chance to take home their “carry” of the loot as they scale their VC-backed ventures.

Learn best practices to properly apply the T2D3 formula to your B2B SaaS growth strategy and attain a sustainable growth formula and pricing model.

How will you achieve T2D3 growth? Learn the 5 factors to build a B2B SaaS growth strategy after achieving product-market fit.

Three areas you can focus on to patch the leaks in your funnel, reduce churn and keep customers to reach T2D3 growth.