In addition to your company maturity on your journey from MVP to PMF and T2D3, you need to account for the maturity of the market you are in. I like to use the proven category maturity model as defined by Geoffrey Moore, in his book, Crossing the Chasm.

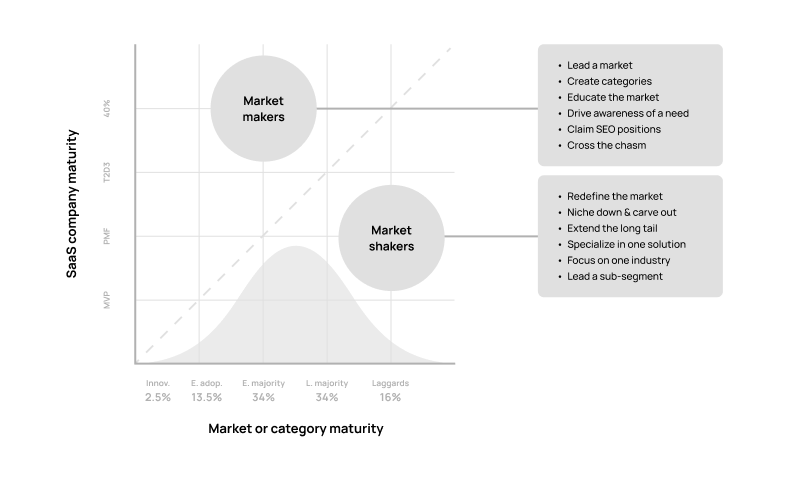

If you are on the left of the spectrum, you need to “make the market,” and that gets easier as you have reached a certain level of maturity for your own business. Conversely, if the market already exists, and you are innovating in an established category, you need to carve out a smaller part of that existing market that you can dominate by “nailing a niche.” When you are planning a GTM strategy and creating a market, the first SaaS Solution that gets to Product Market Fit will likely win. It’s not about being first. It’s about getting to PMF first. If you are entering a relatively mature market, let’s say autonomous vehicles and drones, you can still carve out a part of that market where you can become the leader, like autonomous shipping, and focusing on a specific type of dangerous cargo. You can be first in that subsegment, after the market has been warmed up by the early autonomous vehicle innovators.

Create or Carve Out

To understand the challenges and priorities you are likely to face, you need to understand how much of a “category creating” challenge you will face vs. getting to PMF in the specific niche you carve out in a mature category. The following graph helps you position your own company maturity versus product market fit, compared to the maturity of the market or category you are in. Making a market is costly, and comes with far more risk, in return for larger payoffs and the opportunity to revolutionize a category, or even create a new one. Shaking up an existing market will be a better fit for a solution that can benefit from chasing a competitor and can be executed faster. It also will typically yield a lower return. It’s basically the difference between finding a blue ocean to explore and develop, vs. claiming an island in a crowded red ocean.

It is critical to be realistic about where your business is on both dimensions. For example, your marketing budget will have to be higher for media spend in a more mature market, and getting brand awareness is going to be more expensive when you create a market, given the cost of education of the market. Here is a series of tests and questions you can use to achieve situational awareness on both axes. The tactics you need to deploy dramatically change from being on the left, to the right of the chasm. Early Adopters will likely use your solution to get an edge over their competition. This means they are less likely to tell others about it and be your first reference customers. To get traction with the Early Majority however, you need these references since they like to see others who’ve gone before them. Breaking through this catch 22 is a big part of getting your company from MVP to PMF state. This is one of the main reasons, that in the approach that is described in this book, the creation of customer testimonials is a foundation to many other tactics.

SaaS Company Maturity

Let’s dive a bit deeper into the stages of your company's maturity. How do you recognize where you are, and use that to keep moving forward? The following questions help you do a self-assessment based on two criteria, customer momentum, and user adoption.

Customer Momentum

- MVP: How many customers do you have that pay for your product? Do you have a few that either pay or would pay if they would otherwise lose your service? Have you developed new features based on customer feedback?

- PMF: How many paying customers have renewed at least once? Have some customers agreed to provide references, and be quoted in testimonials? Is customer (logo) churn coming down as you focus on your Ideal Customer Profile (ICP)? Your lead to conversion rates should increase as leads are resembling your ICP.

- T2D3: How many customers have told others about you, and led those to buy your product? Do your new customers come from multiple lead sources? Are your customers consuming more of your services over time? Revenue churn should be negative now and your Annual Revenue per Unit (ARPU) should be growing at least 10% per year. T2D3 momentum starts with customer referrals and growing the revenue you get from each customer, for example by raising prices.

- 100M: Customers are signing up beyond your Ideal Customer Profile (ICP). An ecosystem of partners develops who extend your solution, sell- and service it, or knock on your door to sell it in new geographies. Your Compound Annual Growth Rate (CAGR) and Gross Margin should together be at least 40% (known as the “rule of 40”).

User adoption

- MVP: Are users providing you suggestions to improve your product? This happens when users acknowledge the need for your solution. They “vote with their time” to help you. They will tell you why your solution is important for them and ask you when the next version will be ready.

- PMF: As users start experiencing the value of your solution, do they use it more often? Do they login more frequent? Are your trial users converting to paid users at a higher, faster rate? Are your users praising your solution without you asking them?

- T2D3: Is the number of users per Account growing? Are users referring others, possibly benefiting from some kind of referral program you have rolled out? Is user churn after initial usage going down? A great metric are “engaged advocates”, users who use your product, like using it, and tell others about it.

- 100M: To get to unicorn status your initial group of 1000 raving fans has to multiply. Are user communities forming where they support each other? Have independent user groups and events been organized? Are books being published by 3rd parties to cover your solution with educational content? Are you being named by analyst firms as a leader or category innovator?

The churn challenge

Customer- and user churn are arguably the most important KPIs to determine how mature your SaaS business is. Desirable churn levels will be different based on the market segment your solution is focused on. If you service small businesses, your churn rates will naturally be higher since these companies get created, and go out of business, more frequently vs. large enterprise corporations. Certain industries are more sensitive to the state of the economy and have higher churn rates vs. others. It’s also helpful to differentiate between voluntary churn (customer dissatisfaction) and involuntary churn (for example payment issues).

Over time, your churn rate should go down as your product-market fit improves. This book is focused on B2B SaaS, where healthy churn rates should be below 6% annually to achieve T2D3 growth speed. As you are earlier in your journey, your churn rates can be much higher; typically, 10%+ as you get through PMF growth, and up to 30%-40% annual churn rates for small B2B SaaS Startups closer to MVP stage.

SaaS Category Maturity

If your category, or market, is still to the left of the chasm, chances are that you have to help “make the market”. If the chasm has been bridged, and your audience is educated on their needs, actively seeking out solutions like yours, you are entering an established market, and have to carve out your niche to be special. The following questions can help you understand how mature your market is.

Mature Market

- Do you know what category your solution is in? Can you name it?

- Are there analysts covering the category? Is there a Gartner Magic Quadrant, a Forrester Wave Report, or a Capterra Software Category Listing?

- Are Private Equity, Series C or later stage investments being made into other players in the category? You might even see some M&A activity, roll-ups, and consolidation.

- Are many customer testimonials online of other companies using solutions like yours?

- To win a deal, do you sometimes have to provide a discount to match the alternatives that your prospects have?

- Do your prospects expect to talk to references and want you to show them positive ROI. Are they sophisticated buyers who want to limit their risk?

Immature Market

- You think you are the first to have a solution for the problem you are solving.

- You have not encountered any competition.

- The search terms in Google don’t show others in the results

- Buying Google AdWords clicks is still cheap since people are not searching for what you have to offer.

- Some VCs may have invested in the category, but these are small rounds, investing in relatively unknown players.

- While you have paying customers, you don’t have more than one cycle of annual renewals with them.

Making the market

“Hit ‘em where they ain’t” was a baseball version of the hockey sentence “skate where the puck is going, not where it has been”. It’s a no-brainer that trying to create a new category is the best strategy for high scale growth. When your market is not yet established though, and you help “create the category,” you will need to educate the market. Since your audience has no awareness of a need and is in a natural state of inertia, you will have to knock on the doors of prospects who may not yet realize they have a need. You cannot talk about your solution, as your target buyer personas don’t even acknowledge they have a problem that needs solving. SEO and SEM might not work since nobody is searching for what you have to offer.

Startups who “build it” and hope they will come often don’t realize that they must make the market themselves through targeted outbound marketing (or Account-based Marketing for most B2B solutions) to drive awareness of a need. You’ll need to get attention from niche media that are trusted by your audience and can help educate the market.

If your solution is truly remarkable (meaning, people who are meant to benefit from what you do are making unprompted remarks about it), you can use inbound marketing and count on word of mouth to spread your story. Inbound can also help you do message testing (social media ads are great for this), if you realize that you also have to get the word out and find the watering holes where your audience goes for information.

While your vision should be big to get to $100M ARR, you need to get there one step at a time, just like how winning the World Series is done one game at a time. A great example is Amazon, which started by using software to sell very specific subsegments (books, and later CDs) before moving to many other products. They even waited to service markets outside of North America for many years.

Shaking up the market

If your startup is entering a relatively established category, all is not lost. You can still compete as long as you realize you will need to carve out a subsegment of that market that you can win. You will need to beat the competition with differentiation that is unique in the market subsegment that you focus on. While pay-to-play providers of leads (like capterra and software advice) are dominating SEO and SEM at this point, you can still earn long-tail keyword searches for specific industries, specific solutions, or very targeted market segments (if you’re not familiar with all these terms and tactics, don’t worry, I’ll explain them in subsequent chapters.) Inventory to buy PPC clicks will be limited though, so unless you nail a niche, and get very good at converting high value leads deeper in the funnel, it will be hard to scale.

While an established market can look promising because of its size, it will also be more costly to attain a significant share. Through your positioning you can choose to carve out a part of an existing marketing in a way that it becomes almost a new category, allowing you to be first and become the leader.