Is your B2B SaaS company a daisy or an orchid? Both are great. You can’t be both though.

Do you want to build a reputation as a low-cost provider? Or do you want to build a brand that stands for High-quality software implementation? Or advanced technology?

When assessing the competitive playing field of any Software Product Category, we can use the following simple model:

| |

Simple |

Complete |

| Unique |

Niche |

Premium |

| Commodity |

Volume |

Value |

It’s important to realize that each of these quadrants provides a healthy opportunity to create a valuable, profitable business. It’s hard to optimize for multiple quadrants to be your go-to-market strengths though. Here are some of the trade-offs that are easier to master when you know what you want to be(come).

Technology

A value player will invest in technology to bring down the onboarding-, service- and operating cost of the SaaS Service (the so-called “Cost-to-Service”, CTS). A Premium player will invest in R&D and Visionary Product Leadership.

Go-To-Market strategy

Premium niche players will likely go direct. Value and Volume players will allow a channel to control (part of) the relation with the market, and just add their unique piece of technology to the value chain. Niche players will hire experts in their vertical or segment to give them unique credibility and specialization in a small (but profitable) market.

Customer Success and Support

A value or volume player will optimize for low-cost, self-service support, and easy onboarding. Premium players will invest in Customer Success teams, consulting departments, and paid premier support services to maximize individual customer delight.

Strategy

Niche and Premium players will likely build (and protect) their Intellectual Property. Value and Volume players are more comfortable with licensing, buying, or partnering.

People

Value and Volume players can get by with great utility players who can get the job done for a relatively low cost. Premium and Niche players probably must pay a premium to get the best people for their sales, services, and engineering teams.

Marketing

Finally, marketing will be very different for each of these 4 quadrants. The differences in branding, positioning, messaging, pricing, and the types of campaigns are vast. So, start with finding your superpowers, and then optimize for the quadrant you pick.

Best, Better, Only

What is it that your solution does? What business are you in? What’s it for?

These are questions that are easy to ask by marketing consultants and your customers. They are not easy to answer. Although it appears relatively straightforward, most would be surprised how many companies cannot answer the question “What can only you do?”. It is critical to understand which attributes to focus on when positioning yourselves against your competition, building your messaging, and defining your value proposition pillars.

I’ll walk you through a 3-step model that has never failed me.

Step 1: What do you do best?

What is it that your solution does best? Try to articulate benefits, not features. What makes your solution special?

Think about some of the reasons why customers come to you for a solution, what are some things that your company does extremely well that you’re proud to talk about. Imagine you’re meeting up with an old friend, whom you haven't seen in several years, and you bring up your company – you would probably say “My company is great because XYZ” – what does that sound like? It is important to note that this first step doesn’t necessarily have to be different from your competitors, but special enough that you’re proud of it.

List at least 10 things. More is better. They can be Features, Benefits or Capabilities.

To help you with this exercise, you can find a list of potential superpowers below:

- Luxurious

- Fastest

- Reliable

- Affordable

- Organic

- Sustainable

- Limited

- Professional

- Privacy

- Compliant

- Safe

- Always on

- Mobile

- Long-lasting

- Precise

- Beautiful

- User-friendly

- Simple to use

- Multi-user

- French

- Enterprise-grade

- White-label

- Proven

- Certified

- Compliant

- Oldest

- Newest

- Quality

- Cost to Operate

- Leading Edge

- Scalable

- Secure

- Connecting

- Motivating

- Flexible

- Fun

- Innovative

More categories to consider are specific technologies, applications, distribution channels, and audience-specific needs.

Step 2: What do you do better than others?

What makes you better than your competitors? Why do you win? Using your previous list, filter the superpowers that make you stand out versus your competition. What is it that you do better than anyone else in the market?

Consider “intangible” positioning factors, like reliability, service quality, technology leadership, and product quality. These are often based on customer’s perceptions vs. raw statistics or numbers. These could be things that your customers say about you to others and can be keys to gaining strong product positioning. And if you can make these intangibles tangible, you have a winning formula.

Step 3: What can only you do?

Finally, what makes your solution truly unique? What is something that no other company can do as well as you?

This is where we really differentiate ourselves from the competition. What is the only thing your company can do, and that no one else in the market is doing? This will form the basis of your value proposition pillars. It is normal to feel a little challenged in this section. Not every company will have an “only” and will have to position themselves accordingly. Having about two to three is just the right amount.

- What promise can you make?

- Is there a guarantee you can provide that no other company can match?

- Can you make any undisputed claims about your secret sauce and unique capabilities?

You might find it helpful to find your unique superpower, by limiting the market segment you focus on. For example, Kalungi is the ONLY marketing agency focused on venture-backed B2B SaaS Companies under $50M ARR, allowing them to outsource their complete marketing function including the CMO, and accept accountability for results.

Finally, to stretch your thinking about what makes you unique, imagine what it would take for you to be able to charge double of what you charge today? Or 10x? Answering that question might provide you some ideas of things that could make you even more special in the eyes of your customers.

Positioning – What’s it for?

“The ad is the last thing we do” – This was a regular part of the opening session with Regis McKenna, the first and most famous marketing consultant focused on software ventures, who helped launch Intel and Apple. He always wanted to get the positioning right first. After you’ve discovered your company’s strengths in the previous section, your positioning strategy will allow you to achieve a unique presence in the market.

Many companies try to be all things to all people. There are a couple of reasons you should target your marketing efforts. The obvious reason is that your solutions will naturally have less competition. As a result, it’s easier to establish yourself as a leader in this market segment. Even more important though, is that when a company focuses on a particular market segment, you can do a better job understanding and meeting the needs of the audience you are servicing, and thus be better positioned to win the category.

Driving credibility and recognition starts with answering the following question:

“What’s it for, and why is that special?”

The world is a noisy place, and most customers have too many options to choose from. You need to find a specific niche in the market where you are the undisputed leader. If you can find a part of the market where you can win the hearts and minds of at least 10% of that market, and those are the influential early adopters, you have the beachhead you need to dominate and win that market.

Now that you’ve utilized the “Best - Better - Only” framework to solidify your company’s best attributes and how they compare to your competition, it’s time to narrow down the output from the previous exercise into a handful of elements with which you can position yourself.

Step 4: Choosing the right positioning vectors

Obsess over your ideal customer, figure out exactly what they need to get their job done, and effectively communicate how your product does just that. Use the Best, Better, Only exercise as the basis of comparison with your competition. Select three to five of the best benefits, factors, features, metrics, etc. Ideally, you’ll have enough ideas in the “Only” category to fill your vectors with things that only your company can do, but if not, use ideas from the “Better” area as well.

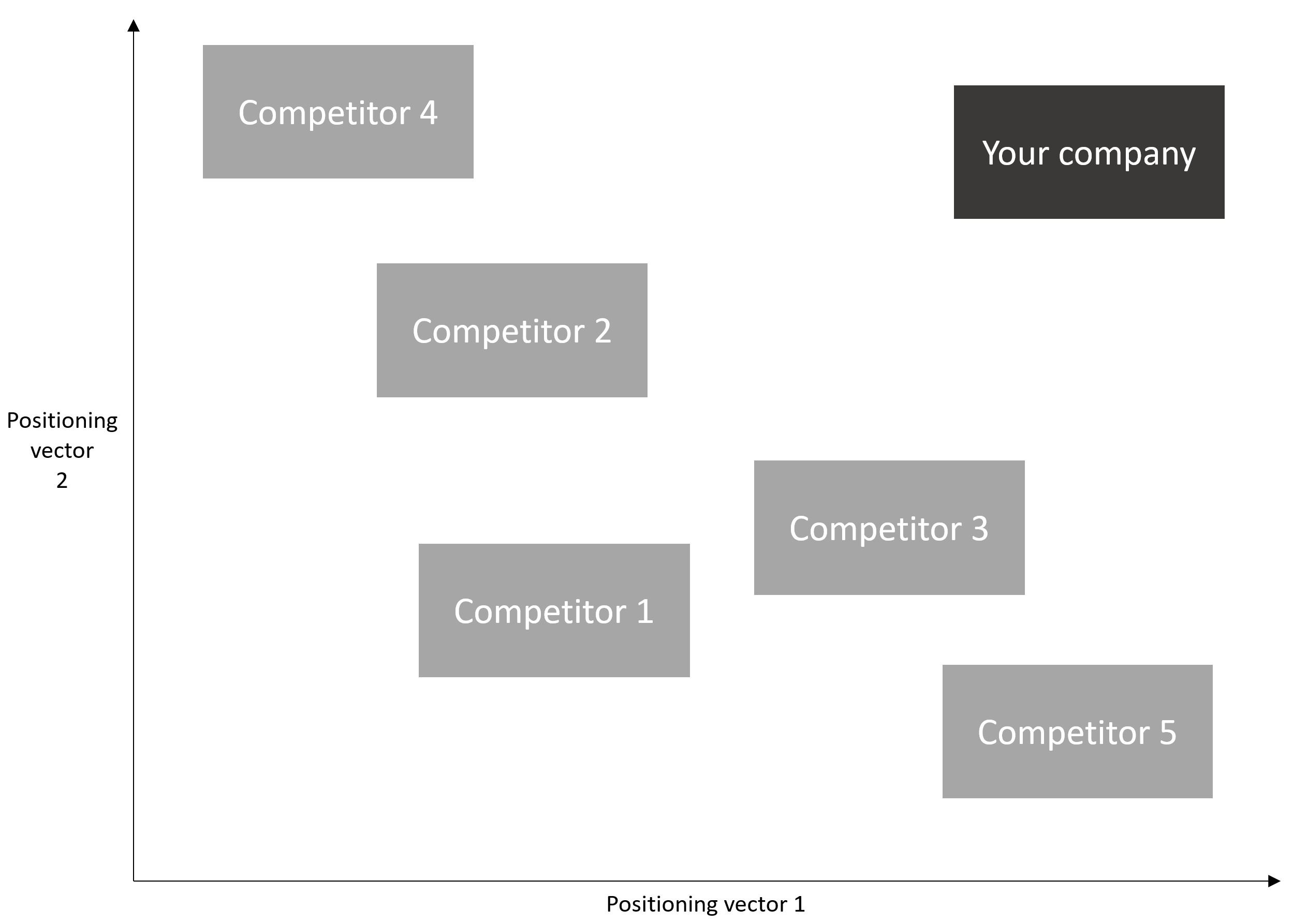

Step 5: Plotting your position vs. the alternatives

Once you’ve narrowed your ideas down to three to five positioning vectors, it’s time to compare your company to your competitors. Of course, it’s even better to create a new market by focusing on the right niche, vs. fighting for market share in an existing market. Even if you can create a new (part of a) market though, we think it’s powerful to compare yourself against the other options your audience has, even if it’s just to pressure test your assumptions.

There are many ways to do this that are discussed below, but the most basic form is on a simple scatter plot. This allows you to compare yourself to your competitors across two different variables and give yourself an objective view of how the marketplace stacks up against your company.

This exercise will force you and your company to take a hard look at the market you play in. See who is the closest to your company on these vectors. They will be your closest competition. Find the vectors for your company and compare your company to your competitors. This will be central to your messaging strategy and will be at the forefront of much of your content, as you go to market.

This exercise will force you and your company to take a hard look at the market you play in. See who is the closest to your company on these vectors. They will be your closest competition. Find the vectors for your company and compare your company to your competitors. This will be central to your messaging strategy and will be at the forefront of much of your content, as you go to market.

If you don't have the resources to do extensive competitive research, ask your team three basic questions:

- What are we better at than anyone else?

- Why can they only get this from us? What makes us unique?

- How is this relevant to our customers? Why should they care?

It always surprises me, that when you listen to your sales team as they talk with prospects, or when you hear your marketing team present at a webinar, how many unique differentiators you already use in your daily communications.

The matrix used previously is a great way to visualize positioning, based on two vectors. But what happens if you are trying to visualize your competitive landscape across more than two vectors?

Here are a couple of other types of charts you can use for competitor analysis and optimize your ultimate SaaS Go-to-Market strategy.